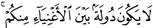

The Holy Qur’an says:

“so that it may not circulate only between the rich among you.” (59:7)

Mufti Taqi Usmani in his address to the World Economic Forum at Davos 2010, presented a paper, titled “Post-Crisis Reforms: Some Points to Ponder”, referring to the 2007-2008 financial crises that shook the world , in which he highlighted that, “One of the basic principles emphasized by the Holy Qur’an about the objectives of an economic system is that wealth produced in a society must be distributed in a just and fair manner, so that it may not be concentrated in the hands of a few people.

This is the very nature of a debt-based economy. The rich becomes richer and the poor poorer as the above verse highlights. The debt based economic system is based on riba (interest), which unjustly transfers complete risk to the borrower.

One of the lessons that we learn from the epitome of financial crises that took place in 2007-2008 is the element of risk transfer which created a domino effect and affected many with its swift. But do we really understand what risk transfer is and how did it lead to a financial crisis?

By definition, risk transfer when one party completely transfers the risk to another party. In the case of the financial crises, the following is what took place:

All risk was transferred from the financial institutions to the borrower and as the borrowers were mostly subprime in nature it led to defaults of loan and brought the entire financial system down. It started off in the United States and then affected the Asian Markets also such as China, Hongkong, Japan, India and so on.

Subprime lending is lending to those individuals who lack the financial stability to ensure timely repayment of installments. Siddiqi (2008) further adheres to this and says that the root cause of economic crises was ‘a moral failure that leads to exploitation and corruption’. The financial institutions failed ethically, in their eagerness to earn more riba (interest) they resorted to subprime lending. Chapra (2008) further attributes that lack of profit-loss sharing (equity-based system) modes of financing led to the crises.

As suggested by Shaykh Muhammad Taqi Usmani, in the same paper, a viable solution to counter this unfair system is to restructure the entire financial system and move away from the current risk transfer system (debt-based) towards a risk sharing system (equity-based).